UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ Preliminary Proxy Statement |

|

|

|

|

|

|

|

|

|

|

—————————

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12

Aemetis, Inc.

(Name of Registrant as Specified in its Charter)

n/a

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

|

|

|

|

|

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

AEMETIS, INC.

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 17, 202329, 2024

March 24, 2023

April 29, 2024

Dear Stockholder:Stockholders:

You are invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of Aemetis, Inc. (the “Company,” “we” or “our”), which will be held at the offices of Shearman & Sterling LLP, 1460 El Camino Real, Floor 2, Menlo Park, CaliforniaCA 94025, on Wednesday, May 17, 202329, 2024, at 1:00 p.m. (Pacific Time).

We discuss the matters to be acted upon at the meeting in more detail in the attached Notice of Annual Meeting and Proxy Statement. There are twofour specific items for which you are being asked to vote:be voted on:

· To elect Naomi L. Boness and Timothy A. Simon as Class III Directors, each to hold office for a three-year term, until their successors are duly elected and qualified; |

|

|

|

|

We hope that you can attend· To ratify the Annual Meeting. You may be requestedappointment of RSM US LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024;

· To approve an amendment to present valid, government-issued photo identificationour Delaware Certificate of Incorporation to gain admissionreduce the number of authorized preferred shares; and,

· To approve an amendment to the Annual Meeting. our Delaware Certificate of Incorporation to provide officer exculpation.

Whether or not you plan to attend the meeting, you can be sure that your shares are represented at the meeting by promptly voting in advance of the meeting by one of the methods provided. Any stockholder of record attending the Annual Meeting may vote in person, even if that stockholder has returned a proxy or voted by telephone or the Internet. Your vote is important, whether you own a few shares or many.

If you have questions concerningabout the proxy, the Annual Meeting, or your stock ownership, please callcontact our Corporate Secretary Todd Waltz,by email at (408) 213-0925.mike.rockett@aemetis.com. Thank you for your continued support of Aemetis, Inc.

Very truly yours, | |||

/s/ Eric A. McAfee | |||

Eric A. McAfee | |||

Chair of the Board and Chief Executive Officer |

This document is dated March 24, 2023 and is being first mailed or made available to stockholders of Aemetis, Inc. on or about March 27, 2023.

20400 Stevens Creek Blvd., Suite 700, Cupertino, CA 95014

Tel.: (408) 213-0940 Fax: (408) 252-8044

Tel: 408-213-0940 - www.aemetis.com

AEMETIS, INC.

NOTICE OF ANNUAL MEETING

OF STOCKHOLDERS

TO BE HELD ON MAY 17, 202329, 2024

March 24, 2023April 29, 2024

To the Stockholders of

AEMETIS, INC.Aemetis, Inc.:

NOTICE IS HEREBY given that the 20232024 Annual Meeting of Stockholders (the “Annual Meeting”) of Aemetis, Inc. (the “Company” or “Aemetis”) will be held at the offices of Shearman & Sterling LLP, 1460 El Camino Real, Floor 2, Menlo Park, CaliforniaCA 94025 on Wednesday, May 17, 202329, 2024, at 1:00 p.m. (Pacific Time) for the following purposes:

1) | To elect | |

2) | To ratify the appointment of RSM US LLP as our independent registered public accounting firm for the fiscal year ending December 31, | |

3) | To |

4) | To approve an amendment to our Delaware Certificate of Incorporation to provide officer exculpation. |

5) | To transact such other business as may properly come before the meeting and any adjournment or postponement thereof. |

The Board of Directors of the Company (the “Board of Directors”) has fixed the close of business on March 20, 2023,April 3, 2024, as the record date for determining the stockholders entitled to receive notice of and to vote at the Annual Meeting and any adjournment thereof. A complete list of such stockholders will be available at the Company’s executive offices at 20400 Stevens Creek Blvd., Suite 700, Cupertino, CA 95014, for ten days before the Annual Meeting.

Our Board of Directors recommends that you vote:

· | “ | |

· | “ |

· | “FOR” the approval of the proposed amendment to our Delaware Certificate of Incorporation to reduce the number of authorized preferred shares |

We are pleased to take advantage of the SEC rules that allow companies to furnish their proxy materials over the Internet. As a result, we are mailing to our stockholders a Notice of Internet Availability of Proxy Materials (the “Internet Availability Notice”) instead of a paper copy of this proxy statement (the “Proxy Statement”) and our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (the “2022 Annual Report”). The Internet Availability Notice contains instructions on how to access those documents over the Internet. The Internet Availability Notice also contains instructions on how to request a paper copy of our proxy materials, including this Proxy Statement, our 2022 Annual Report and a form of proxy card or voting instruction card, as applicable. We believe that this process will reduce the costs of printing and distributing our proxy materials, is better for the environment and provide other benefits.

· | “FOR” the approval of the proposed amendment to our Delaware Certificate of Incorporation to provide officer exculpation |

You are encouraged to vote. Each stockholder will either receive an email with instructions for access to proxy materials and voting or will receive a full set of proxy materials, depending on preferences you have provided. You can vote on the internet or by phone by following the instructions included in this Proxy Statement or by following the instructions detailed in the Internet Availability Notice, as applicable.materials you receive. If you are ablereceive a proxy card, you can also vote by completing and returning the card. If you want to attend the Annual Meeting and wish to vote in person, you may do so whether or not you have returned yourvote or return a proxy or voted by telephone or the Internet.in advance.

BY ORDER OF THE BOARD OF DIRECTORS | |||

| |||

| |||

| |||

| /s/ J. Michael Rockett | |||

| J. Michael Rockett | |||

| Executive Vice President, General Counsel, | |||

| and Corporate Secretary |

YOUR VOTE IS IMPORTANT, WHETHER YOU OWN A FEW SHARES OR MANY.

AEMETIS, INC.

20400 Stevens Creek Blvd., Suite 700, Cupertino, CA 95014

Tel.: (408) 213-0940 Fax: (408) 252-8044

www.aemetis.com

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 17, 2023 29, 2024

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 17, 202329, 2024

INFORMATION CONCERNING SOLICITATION OF PROXIES AND VOTING

General

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of the CompanyAemetis, Inc. (the “Board of Directors” or the “Board”) for use at the Annual Meeting of Stockholders of the Company (the “Annual Meeting”) to be held on Wednesday, May 17. 2023, or at any adjournment thereof, for the purposes set forth herein and in the foregoing Notice of Annual Meeting of Stockholders. The Annual Meeting will be held at the offices of Shearman & Sterling LLP, 1460 El Camino Real, Floor 2,nd Floor, Menlo Park, CaliforniaCA 94025 on Wednesday, May 17, 202329, 2024, at 1:00 p.m. (Pacific Time). The 2022 Annual Report is also available from the Company, without charge, upon request made in writing to the Company’s Corporate Secretary at our executive offices at 20400 Stevens Creek Blvd., Suite 700, Cupertino, CA 95014, or online at www.aemetis.com. Your attention is directed to the financial statements and Management’s Discussion and Analysis in the 2022 Annual Report, which provides additional important information concerning the Company. This Proxy Statement, the related proxy card and the 2022 Annual Report are being first mailed or made available to stockholders of Aemetis, Inc. on or about March 27, 2023.

In accordanceStockholders who have authorized electronic communication will receive an email with the rules and regulations adopted by the U.S. Securities and Exchange Commission (the “SEC”), we have elected to provide our stockholders access to our proxy materials by providing access to such documentsinstructions on the Internet. Accordingly, a Notice of Internet Availability of Proxy Materials (the “Internet Availability Notice”) has been mailed to our stockholders. Stockholders that received the Internet Availability Notice have the abilityhow to access the proxy materials including this Proxy Statement, our 2022 Annual Report and to vote. Stockholders who have not authorized electronic communication will receive a formphysical set of proxy cardmaterials and proxy card.

All stockholders have the ability to vote on the internet or voting instruction card, as applicable, on a website referred to in the Internet Availability Notice or to request that a printed set of the proxy materials be sent to them,by phone by following the instructions in the Internet Availability Notice.

The Internet Availability Noticeemail or mailing that you receive. If you receive a proxy card, you can also provides instructions on how to inform us to send future proxy materials to youvote by mail. Your election to receive proxy materials by mail will remain in effect until you terminate it.

Important Notice Regardingreturning the Availability ofcard. This Proxy Materials forand the

Stockholders’ Meeting to Be Held on Wednesday, May 17, 2023

The Notice of Annual Meeting of Stockholders, this Proxy Statement and 2022 Annual Report are also available at www.iproxydirect.com/AMTX free of charge.www.ProxyVote.com, our website at www.aemetis.com, and on the SEC EDGAR website for company filings.

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND OUR ANNUAL MEETING

Q: | What is the purpose of the Annual Meeting? | ||

A: | To vote on the following proposals: | ||

| ● | To elect | ||

| ● | To ratify the appointment of RSM US LLP as our independent registered public accounting firm for the fiscal year ending December 31, |

| ● | To approve an amendment to the Company’s Delaware Certificate of Incorporation to reduce the number of authorized preferred shares; and | ||

| ● | To approve an amendment to the Company’s Delaware Certificate of Incorporation to provide officer exculpation. | ||

Q: | What are the Board of | ||

| A: | |||

| The Board recommends a vote: | ||

|

| “FOR” the individuals nominated for election to the Board of | |

| ● | “FOR” ratification of RSM US LLP as our independent registered public accounting firm for the fiscal year ending December 31, | |

| ● | “FOR” the amendment of the Company’s Delaware Certificate of Incorporation to reduce the number of authorized preferred shares | |

| ● | "FOR” the amendment of the Company’s Delaware Certificate of Incorporation to provide officer exculpation | ||

| ● | “FOR” or “AGAINST” other matters that properly come before the Annual Meeting, as the proxy holders deem |

Q: | Why did I receive an | ||

A: |

| ||

Q: | What are my options for voting methods? | ||

|

If you receive a proxy card or request one, you can also vote by completing and returning the | ||

|

| ||

| Who is entitled to vote at the meeting? | ||

A: |

| ||

Q: | What is the difference between registered stockholders and street name stockholders? | ||

A: | Registered Stockholders. If your shares are registered directly in your name with the Company’s transfer agent, you are considered, with respect to those shares, | ||

Q: Can I attend the meeting in person? A: Q: If I A: Q: What should I do if I get more than one set of voting materials? A: Stockholders may receive more than Q: Can I change my vote? A: Registered Stockholders. You may change your vote at any time prior to the vote at the Annual Meeting. To revoke your proxy instructions and change your vote if you are a holder of record, you must (i) attend the Annual Meeting and vote your shares in person, (ii) advise Street Name Stockholders. If you hold your shares through a broker, bank or other nominee, please follow the instructions provided by your broker, bank or other nominee as to how you may change your vote or obtain a “legal proxy” to vote your shares if you wish to cast your vote in person at the Annual Meeting. Q: What happens if I decide to attend the Annual Meeting, but I have already voted or submitted a proxy covering my shares? A: You may attend the meeting and vote in person even if you Q: What is the voting requirement to approve each of the proposals? A: Q: What are A: A broker non-vote occurs when shares held by a broker are cast for one matter but not At our Annual Meeting, the Company believes that only Proposal No. 2 (ratifying the appointment of our independent registered public accounting firm) is considered a routine item. This means that brokers may vote in their discretion on this matter on behalf of clients who have not furnished voting instructions. Brokers who have not been furnished voting instructions from their clients will not be authorized to vote in their discretion on the “non-routine” proposals. Q: How are abstentions and broker non-votes counted? A: Number 2, and broker non-votes and abstentions will have the same effect as a vote "AGAINST" Proposals 3 and 4. Q: What constitutes a quorum? A: For purposes of our Annual Meeting, a “quorum” is the presence, in person or by proxy, of a majority of the outstanding voting power of the Company, which Q: How are votes counted? A: Aemetis Q: Who is making this solicitation? A: This proxy is being solicited on behalf of the Board of Directors of Aemetis, Inc. Q: Who pays for the proxy solicitation process? A: Aemetis will pay the cost of preparing, emailing, assembling, printing, mailing, distributing, and making available these proxy materials and soliciting votes. We do not currently plan to retain a proxy solicitor to assist with the solicitation. We may, on request, reimburse brokerage firms and other nominees for their expenses in forwarding or making available proxy materials to beneficial owners. In addition to soliciting proxies by email and mail, we expect that our directors, officers and employees may solicit proxies in person, by phone, or by other electronic means. None of these individuals will receive any additional or special compensation for doing this, although we will reimburse these individuals for their reasonable out-of-pocket expenses. Q: May I propose actions for consideration at next A: You may present proposals for action at a future meeting only if you comply with the requirements of the proxy rules established by the With respect to A: If you If you are registered stockholder, please contact our transfer agent, Equiniti, householding. Q: What if I have questions about a lost stock A: If you are a registered stockholder, your holdings may be either certificated or may be recorded electronically in certificateless form. Please contact our transfer agent, Equiniti, BOARD OF DIRECTORS The Name Age Position Director Classification Eric A. McAfee 61 Chair of the Board and Chief Executive Officer 2006 Class I (2025) Francis P. Barton 77 Lead Independent Director 2012 Class I (2025) Lydia I. Beebe 71 Director 2016 Class II (2026) John R. Block 89 Director 2008 Class II (2026) Naomi L. Boness 47 Director and nominee 2020 Class III (2024) * Timothy A. Simon 68 Director and nominee 2021 Class III (2024) * (*) Current term expires in 2024. The The Board of Directors has determined that all of its current directors Our Board retains flexibility to select its Board Management of Risk Both the full Board and its committees oversee the various risks faced by the Company. Management is responsible for the day-to-day management of the Board oversight of risk is conducted primarily through the standing committees of the Board, the members of which are independent directors, with the Audit Committee taking a lead role on oversight of financial risks and in interfacing with management on significant risks or exposures and assessing the steps management has taken to minimize such risks. The Audit Committee is also charged with, among other tasks, oversight of management on the Company’s guidelines and policies with respect to risk monitoring, assessment and management. Members of the Company’s management periodically report to the Audit Committee regarding risks overseen by the Audit Committee, including quarterly reports with respect to the Company’s internal controls over financial Board Member Biographies Name Age Position Director Since Classification (Term Expiration) Eric A. McAfee 60 Chief Executive Officer, Chairman of the Board 2006 Class I (2025) Francis P. Barton 76 Lead Independent Director 2012 Class I (2025) Lydia I. Beebe 70 Director and nominee 2016 Class III (2026) * John R. Block 88 Director and nominee 2008 Class III (2026) * Naomi L. Boness 46 Director 2020 Class II (2024) Timothy A. Simon 67 Director 2021 Class II (2024) Eric A. McAfeeco-founded the Company in Francis P. Bartonwas appointed to the Company’s Board in August 2012. Mr. Barton serves as the Lead Independent Director, the Chair of the Audit Committee and as a member of the Governance, Compensation and Nominating Committee. His executive experience as well as his extensive financial background qualify him for the position. From 2008 to present, Mr. Barton served as Chief Executive Officer in the consulting firm Barton Business Consulting LLC. Prior to this, Mr. Barton served as the Executive Vice President and Chief Financial Officer of UTStarcom, Inc. from 2005 through 2008 and as a director from 2006 through 2008. From 2003 to 2005, Mr. Barton was Executive Vice President and Chief Financial Officer of Atmel Corporation. From 2001 to 2003, Mr. Barton was Executive Vice President and Chief Financial Officer of Broadvision Inc. From 1998 to 2001, Mr. Barton was Senior Vice President and Chief Financial Officer of Advanced Micro Devices, Inc. From 1996 to 1998, Mr. Barton was Vice President and Chief Financial Officer of Amdahl Corporation. From 1974 to 1996, Mr. Barton worked at Digital Equipment Corporation, beginning his career as a financial analyst and moving his way up through various financial roles to Vice President and Chief Financial Officer of Digital Equipment Corporation’s Personal Computer Division. Mr. Barton holds a B.S. in Interdisciplinary Studies with a concentration in Chemical Engineering from Worcester Polytechnic Institute and an M.B.A. with a focus in finance from Northeastern University. Mr. Barton served on the board of directors of ON Semiconductor from 2008 to 2011. Mr. Barton has served on the board of directors of SoSo Cards since January 2013. He Lydia I. John R. Blockhas served as a member of the Company’s Board of Directors since October 2008. Mr. Block serves as a member of the Company’s Governance, Compensation and Nominating Committee. His experience with agricultural commodities, understanding of political affairs, and prior board experience qualify him for the position. From 1981 to 1986, Mr. Block served as United States Secretary of Agriculture under President Ronald Reagan. He is currently an Illinois Dr. Naomi L. Boness was appointed to the Company’s Board of Directors in June 2020. Dr. Boness serves as a member of the Company’s Audit Committee. Her experience in the energy business and her expertise in investment analysis and strategic planning qualify her for the position. Dr. Boness has been corporation, and of Babcock & Wilcox (NYSE: BW). Prior to Stanford, Dr. Boness held a variety of technical and management positions at Chevron including as a member of the prestigious Reserves Advisory Committee and as a Senior Analyst for Upstream Strategy and Planning from 2016 to 2019. Dr. Boness received her Timothy A. Simonwas appointed to the Company’s Board in 2021. Mr. Simon serves as a member of the Company’s Audit Committee. Prior to his CPUC appointment, Mr. Simon served as Appointments Secretary in the Office of the Governor, the first African American in California history to hold this post. He also served as an Adjunct Professor of Law at Golden Gate University School of Law and the University of California College of the Law, San In 2013, Mr. Simon created TAS Strategies as an attorney and consultant on utility, infrastructure, financial services, and broadband projects. He is a frequent public speaker, expert witness, and panelist on energy, infrastructure, diversity, and inclusion. In 2019, Mr. Simon was elected Chairman of the Board of Directors for the California African American Chamber of Commerce and elected to the University of San Francisco Board of Trustees. He serves as Vice Chair of the North American Energy Standards Board Advisory Council and is a member of the National Bar Association, Energy Bar Association, the Saint Thomas More Society, and the National Board of Directors for the American Association of Blacks in Energy. Mr. Simon received a The Board has The following Name Audit Governance, Compensation and Nominating Committee Eric A. McAfee - - M Francis P. Barton C M M Lydia I. Beebe - C - John R. Block - M - Naomi L. Boness M - - Timothy A. Simon M - - Note:C = Chair, M = Member Audit CommitteeStreet Name Stockholders. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered, with respect to those shares, the beneficial owner of shares held in street name. The Internet Availability Notice is being forwarded to you by your broker or nominee, who is considered, with respect to those shares, the record holder. As the beneficial owner, you have the right to direct your broker or nominee how to vote andby following the instructions in the email or mailing that you receive. You are also invited to attend the Annual Meeting. However, since you are not the record holder, you may not vote for these shares in person at the Annual Meeting unless you follow your broker’s procedures for obtaining a legal proxy. Your broker or nominee will provide a voting instruction card for you to use.You are invited toYes, you may attend the Annual Meeting if you are a registered stockholder or a street name stockholder as of March 20, 2023.April 3, 2024. You may be requestedasked to present valid, government-issued photo identification, such as a driver’s license or passport, to gain admission to the Annual Meeting.Q:How can I vote my shares?A:Registered Stockholders. Registered stockholders may vote in person at the Annual Meeting or by one of the following methods:●By Mail. Complete, sign and date the proxy card and return it in the prepaid envelope provided.●By Fax. Complete, sign and date the proxy card and fax to 202-521-3464.●By Internet. Go to https://www.iproxydirect.com/AMTX and follow the instructions.●By Telephone. Call 1-866-752-VOTE (8683) and follow the instructions.Please note that voting facilities for registered stockholders will close at 11:59 P.M. (Eastern Time) on Tuesday, May 16, 2023.Street Name Stockholders. If your shares are held by a broker, bank or other nominee, you must follow the instructions on the form you receive from your broker, bank or other nominee in order for your shares to be voted. Please follow their instructions carefully. Also, please note that if the holder of record of your shares is a broker, bank or other nominee and you wish to vote in person at the Annual Meeting, you must request a legal proxy from the bank, broker or other nominee that holds your shares and present that proxy and proof of identification at the Annual Meeting to vote your shares.Based on the instructions provided by the broker, bank or other holder of record of their shares, street name stockholders may generally vote by one of the following methods:●By Mail. You may vote by signing, dating and returning your voting instruction card in the enclosed pre-addressed envelope.●By Methods Listed on the Voting Instruction Card. Please refer to your voting instruction card or other information forwarded by your bank, broker or other holder of record to determine whether you may vote by Internet, telephone, mail or fax, and follow the instructions on the voting instruction card or other information provided by the record holder.●In Person with a Legal Proxy from the Record Holder. A street name stockholder who wishes to vote at the Annual Meeting will need to obtain a legal proxy from his or her bank or brokerage firm. Please consult the voting instruction card sent to you by your bank or broker to determine how to obtain a legal proxy in order to vote in person at the Annual Meeting. 7Table of Contentssignsubmit a proxy, how will it be voted?When proxies are properly delivered, theThe shares represented by such proxiesa properly submitted proxy will be voted at the Annual Meeting in accordance with the instructions of the stockholder. However, if no specific instructions are given, the shares will be voted in accordance with the above recommendations of our Board of Directors. If any matters not described in the Proxy Statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote for your shares. If the Annual Meeting is adjourned, the proxy holders can vote your shares on the new meeting date as well, unless you have revoked your proxy instructions as described below under “Can I change my vote?”one set of voting materials, including multiple Internet Availability Notices,email or voting instruction cards. For example, stockholders whomailing. This may happen if you hold shares in more than one brokerage or record account mayor if multiple people in your household own shares. Each email or mailing you receive a separatewill provide one or more unique codes for voting instruction card for each brokerage account in whichthe specific shares are held. Stockholders of record whose shares are registered in more than one name will receive more than one Internet Availability Notice. Youcovered by the communication. Therefore, you should vote separately in accordance with the instructions in each Internet Availability Notice and voting instruction cardseparate code you receive relating to our Annual Meeting to ensure that all of your shares are voted.Todd Waltz,Mike Rockett, the Company’s Corporate Secretary, at our principal executive office in writing before the proxy holders vote your shares, or (iii) deliver later dated proxy instructions in one of the manners authorized and described in this Proxy Statement (such as via the Internet or by telephone). 8Table of Contents have already voted or submitted a proxy. Please be aware that attendance at the Annual Meeting will not, by itself, revoke a proxy. If a bank, broker or other nominee holds your shares and you wish to attend the Annual Meeting and vote in person, you must obtain a “legal proxy” from the record holder of the shares giving you the right to vote the shares.● Proposal No. 1: Directors are elected by a plurality vote. The two director nominees who receive the most votes cast in his/hertheir favor will be elected to serve as directors.● Proposal No. 2: Must be approved by the affirmative vote of a majority of the shares entitled to vote and present in person or represented by proxy at the Annual Meeting. ● Proposal No. 3: Must be approved by the affirmative vote of a majority of the shares entitled to vote at the Annual Meeting ● Proposal No. 4: Must be approved by the affirmative vote of two-thirds of the shares entitled to vote at the Annual Meeting “broker“broker non-votes?” voted with respect to a particulardifferent proposal because the broker does not have discretionary authority to vote on the matter and has not received voting instructions from its clients.client. If your broker holds your shares in its name and you do not instruct your broker how to vote, your broker will only have discretion to vote your shares on "routine" matters. WhereWhen a proposal is not "routine," a broker who has not received instructions from its clients does not have discretion to vote its clients' uninstructed shares on that proposal.mattermatters found in Proposal No. 1.Numbers 1, 3, and 4. Accordingly, for beneficial stockholders, if you do not give your broker specific instructions, your shares may not be voted on such proposal.Abstentions and broker non-votesProxies provided by brokers will be counted for purposes of calculating whether a quorum is present at the Annual Meeting, and will be counted for purposes of determining whether proposals requiring approval by the affirmative vote of a majorityincluding proxies which contain votes on less than all of the shares entitled to vote thereon or the affirmative vote ofmatters presented. Except for establishing a majority of the shares entitled to votequorum, broker non-votes and present in person or represented by proxy at the Annual Meeting. Thus, an abstention or broker non-voteabstentions will have no effect on Proposal No.Number 1, and an abstention will be countedhave the same effect as a vote “AGAINST” Proposal No. 2. 9Table of Contentsincludesis based on shares of common stock and preferred stock (with the preferred stock being counted on an as-converted-to-common stock basis), represented in person or by proxy at the meeting. If you have returned valid proxy instructions or you attend the Annual Meeting in person, your stock will be counted for the purpose of determining whether there is a quorum, even if you wish to abstain from voting on some or all matters at the meeting. All shares of Aemetis common stock and preferred stock (with the preferred stock being counted on an as converted to common stock basis) represented at the Annual Meeting, including broker non-votes and abstentions, will be counted for purposes of determining the presence of a quorum. There must be a quorum for our Annual Meeting to be held.will designate Issuer Directhas designated Broadridge as the Inspectorour tabulator of Election who will tabulate the votes. The Inspectorvotes and inspector of Electionelections. Broadridge will separately count “FOR,” “WITHHOLD” and “AGAINST” votes, as well as abstentions and broker non-votes.Aemetis. 10Table of Contentsyear’syear’s annual meeting of stockholders or nominate individuals to serve as directors?SEC.SEC and our bylaws. In order for a stockholder proposal to be included in our Proxy Statement and form of Proxy relating to the meeting for our 20242025 Annual Meeting of Stockholders under Rule 14a-8 adopted under Section 14(a) of Securities Exchange Act of 1934, as amended (the “Securities Exchange Act”), the proposal must be received by us no later than 5:00 p.m. (Pacific Time) on the 90th day, and not earlier than on the 120th day, prior to the first anniversary of the mailing of the notice for the preceding year’s annual meeting. Accordingly, stockholder proposals intended to be presented in our proxy materials for the 20242025 Annual Meeting must be received by Todd Waltz,Mr. Rockett, the Company’s Corporate Secretary, on or after November 27, 2023,December 30, 2024, and prior to 5:00 p.m. (Pacific Time) on December 27, 2023January 29, 2025, and must satisfy the requirements of the proxy rules promulgated by the SEC. If our 20242025 Annual Meeting of Stockholders is not held within 30 days of May 17,29, 2024, we will publicly announce a different submission deadline from thatthan set forth above in compliance with SEC rules. The public announcement of an adjournment or postponement of our 2024 Annual Meeting of Stockholders will not trigger a new time period (or extend any time period) for the giving of a stockholder’s notice as described in this Proxy Statement.In accordance with our Bylaws, in orderQ:be properly brought before our 2024 Annual Meeting, regardless of inclusion in our proxy statement, notice of a matter a stockholder wishes to present, including any director nominations, must be delivered to the Company at the physical address provided below, not earlier than fifty (50) days nor more than eighty (80) days in advance of the scheduled date of the annual meeting of stockholders, regardless of any postponement, deferral or adjournment of that meeting to a later date; provided, however, that, if fewer than sixty (60) days’ notice or prior public disclosure of the date of the meeting is given or made to stockholders, notice by the stockholder to be timely must be so delivered or mailed and received not later than the close of business on the tenth (10th) day following the earlier of (a) the day on which such notice of the date of the meeting was mailed or (b) the day on which such public disclosure was made. The stockholder must also provide all of the information required by our Bylaws.Q:Howfuture proxies, how do I obtain a separate set of proxy materials or request a single set for my household?share an address with another stockholder, have the same lasthold shares in street name, you should contact your broker to adjust your preference for electronic communication and do not participate in electronic delivery of proxy materials, you will receive only one set of proxy materials (including our 2022 Annual Report and this Proxy Statement)for combining documents into a single mailing ("householding"). If youStreet name stockholders who wish to receive a separate set of proxy statement at this time, please request an additional copymaterials in future mailings can also be removed from the householding program by contacting the Broadridge Householding Department by phone at 1-866-540-7095, or by writing to: Broadridge, Householding Department, 51 Mercedes Way, Edgewood, NY 11717.by telephone at (866) 877-6270.You may also request to receive a separate 2022 Annual Report and a separate proxy statement by contactingor our Corporate Secretary by telephone at (408) 213-0940, by email at twaltz@aemetis.com,to change your preferences for electronic communication or by writing to: Aemetis, Inc., 20400 Stevens Creek Blvd., Suite 700, Cupertino, CA 95014, Attn.: Corporate Secretary.certificatescertificate or need to change my mailing address?YouIf you hold your shares in street name, contact your broker for changes or questions about your account. Stock held in street name is typically electronic only, without certificates.by telephone at (866) 877-6270 if you have questions, need to replace a lost your stock certificate, or need to change your mailing address.11Table of Contents MEETINGS AND COMMITTEESBoard of Directors is presently composed of six (6) members: Eric A. McAfee, Francis Barton, Lydia I. Beebe, John R. Block, Naomi L. Boness and Timothy A. Simon. Mr. McAfee serves as Chairman of the Board of Directors. There are no family relationships between any director and executive officer.The Board of Directors held six (6) meetings during the fiscal year 2022. Each director attended all of the meetings offollowing table lists our Board members as of Directors and ofApril 29, 2024, the committees onclass under which each director served, as applicable, during fiscalserves, and the expiration year 2022.of the term of each director:

Since

(Term Expiration) Board encouragesDirector's term will expire in 2027 if reelected. Note that the directorsclass number designation for "Class II" and "Class III" have been changed from prior proxies to attendreflect the annual meetingschronological order of stockholders.the expiration year for each classification, but each Director's term of office has not changed.BOARD INDEPENDENCEBoard Member Independence except Eric A. McAfee, who currently serves as Aemetis’ Chief Executive Officer, are independent directors within the meaning set forth in the applicable rules and regulations of the SEC and Thethe NASDAQ Stock Market, LLC, as currently in effect.effect, except for Eric A. McAfee, who is considered to be not independent because he is also an Executive Officer currently serving as Chair of the Board and Chief Executive Officer. There are no family relationships between any independent director and executive officer.BOARD LEADERSHIP STRUCTURE AND BOARD’S ROLE IN RISK OVERSIGHTBoard LeadershipChairmanChair of the Board and Chief Executive Officer in the manner that it believes is in the best interests of our stockholders. Accordingly, the ChairmanChair of the Board and the Chief Executive Officer positions may be filled by one individuala single person or two.filled separately by two people. The Board currently believes that having Mr. McAfee serve as both Chair of the Board and Chief Executive Officer and Chairman of the Board is in the best interests of the stockholders givenin light of Mr. McAfee’s extensive knowledge of, years of service to, and experience with the Company. The Board has designated Francis P. Barton as Lead Independent Director to preside over the Board’s executive sessions and fulfill other duties.Company’s risksCompany and provides periodic reports to the Board and its committees relating to those risks and risk-mitigation efforts.reporting.reportingSet forth below is information regarding our directors as of March 24, 2023, the class under which each director serves and, assuming the reelection of the director nominees at the Annual Meeting, the expiration of the term of such director:* Term expiration assuming reelection.12Table of Contents20052006 and has served as its ChairmanChair of the Board since February 2006. Mr. McAfee was appointed Chief Executive Officer of the Company in February 2007. Mr. McAfee’s industry experience and leadership skills qualify him for this position. Mr. McAfee has been an entrepreneur, merchant banker, venture capitalist and farmer/dairymandairy operator for more than 20 years. Since 1995, Mr. McAfee has been the Chairman of McAfee Capital and since 1998 has been a principal of Berg McAfee Companies, an investment company. Since 2000, Mr. McAfee has been a principal of Cagan McAfee Capital Partners through which Mr. McAfee has founded or acquired twelve energy and technology companies. In 2003, Mr. McAfee co-founded Pacific Ethanol, Inc. (NASDAQ: PEIX)(formerly NASDAQ: PEIX, now ALTO), a West Coast ethanol producer and marketer. Mr. McAfee received a B.S. in Management from Fresno State University in 1986 and served as Entrepreneur in Residence of The Wharton Business School MBA Program in 2007. Mr. McAfee is a graduate of the Harvard Business School Private Equity and Venture Capital Program and is a 1993 graduate of the Stanford Graduate School of Business Executive Program. Mr. McAfee’s industry experience and leadership skills qualify him for the position.is also servinghas served on the board of directors of Inventergy since January 2014, and is the ChairmanChair of its Audit Committee, and a member of its Compensation, Governance and Nominating Committee. Mr. Barton served on the board of directors of Etubics, Inc. from 2014 to 2016, and was chair of its Audit Committee and a member of its Compensation, Governance and Nominating Committee.Mr. Barton serves as the Lead Independent Director, the Chairman of the Audit Committee and as a member of the Governance, Compensation and Nominating Committee of the Company. His executive experience as well as his extensive financial background qualify him for the position.Beebe Beebe was appointed to the Company’s Board of Directors in November 2016. Ms. Beebe serves as the Chair of the Governance, Compensation and Nominating Committee. Her extensive experience as an executive for a major oil company, her expertise in corporate governance, and experience with other public company boards qualify her for the position. Ms. Beebe is Principal of the corporate governance consulting business, LIBB Advisors. She was Senior of Counsel for Wilson Sonsini Goodrich and Rosati from 2015 until 2017. Prior to this, Ms. Beebe held a number of senior roles at Chevron Corporation, (“Chevron”), including Chief Governance Officer and Corporate Secretary. In 1995, Ms. Beebe was promoted to Corporate Secretary and an Officer of the company,Chevron, the first female corporate officer in Chevron’sthe company's 127-year history. In 2007, she also became the Chief Governance Officer until she retired in 2015. Ms. Beebe holds a B. S.B.S. in journalism from University of Kansas, a J.D. from the University of Kansas, as well as a M.B.A. from Golden Gate University. Ms. Beebe previously served on the boards of directors of Kansas City Southern (NYSE: KSU), HCC Insurance Holdings, Inc. (NYSE: HCC), the Council of Institutional Investors, Presidio Trust, the University of Delaware’s Weinberg Center for Corporate Governance, and the California Fair Employment & Housing Commission. She currently serves on the boards of Stanford University’s Rock Center for Corporate Governance, Kansas City Southern (KCS) voting trust following the acquisition of KCS by Canadian Pacific Railway, having previously served on the board of Kansas City Southern (NYSE: KSU), EQT Corp. (NYSE:EQT), and Paxon Energy & Infrastructure.13Table of ContentsMs. Beebe serves as the Company’s Chairman of the Governance, Compensation and Nominating Committee. Her extensive experience as an executive for a major oil company, her expertise in corporate governance and experience with other public company boards qualify her for the position.farmer andfarmer. From 2005 to 2023, Mr. Block was a Senior Policy Advisor to Olsson Frank Weeda Terman Bode Matz PC, an organization that represents the food industry. Mr. Block has held this position since January 2005. From January 2002 to January 2005, he served as Executive Vice President at the Food Marketing Institute, an organization representing food retailers and wholesalers. From February 1986 to January 2002, Mr. Block served as President of Food Distributors International. Mr. Block is currently a member of the board of directors of Digital Angel Corporation and Metamorphix, Inc. Mr. Block previously served on the board of directors of each of Deere and Co., Hormel Foods Corporation, and Blast Energy Services, Inc. Mr. Block received his Bachelor of Arts degree from the United States Military Academy.Mr. Block serves as a member of the Company’s Governance, Compensation and Nominating Committee. His experience with agricultural commodities, understanding of political affairs, and prior board experience qualify him for the position. serving as the Managing Director of the Stanford Natural Gas Initiative since 2019 and the Co-Managing Director of the Stanford Hydrogen Initiative since 2022.2023. She is a member of the Renewable Natural Gas Coalition Advisory Committee;Committee, a member of the Partnership to Address Global Emissions Advisory Council;Council, a member of the Open Hydrogen Initiative Independent Expert Panel;Panel, a former invited member of the United Nations Expert Group on Resource Classification;Classification, and a former Chair of the Society of Exploration Geophysicists Oil and Gas Reserves Committee. As an advocate for women and gender equality, she is proud to be an Ambassador for the Women in Clean Energy, Education and Empowerment (C3E) Initiative. She currently serves on the boardboards of geCKo Materials, a public benefit corporation.B.Sc.Bachelor of Science degree in Geophysics from the University of Leeds in 1998, her M.Sc.Masters of Science in Geological Science from Indiana University in 2000, and her Ph.D. in Geophysics from Stanford University in 2006.Dr. BonessHerHis experience in the energy business and herhis expertise in investment analysiswith utility, infrastructure and strategic planningfinancial services qualify herhim for the position.Timothy Alan Simon was appointed to the Company’s Board in 2021. Mr. Simon was appointed to the CPUC by Governor Arnold Schwarzenegger in February 2007, ending his term in December 2012. During his time as a CPUC commissioner, Mr. Simon served as Chair of the National Association of Regulatory Utility Commissioners (“NARUC”) Gas Committee;Committee, Chair of the LNG Partnership between the Department of Energy and NARUC;NARUC, founding member of the Call to Action National Gas Pipeline Safety Taskforce with the U.S. Department of Transportation;Transportation, and member of the National Petroleum Council. Mr. Simon currently serves on the board of Charah Solutions, Inc. (NYSE: CHRA).Francisco .Francisco. Before public service, Mr. Simon was an in-house counsel and compliance officer with Bank of America, Wells Fargo, and the Robertson Stephens investment bank.bachelor’sBachelor’s degree in Economics from the University of San Francisco (Distinguished Alumni) and a Juris Doctor degree from the University of California College of the Law, San Francisco. He is an active member of the State Bar of California.14Table of ContentsMr. Simon serves as a memberCommittees of the Company’s Audit Committee. His experience in the energy business and his expertise on utility, infrastructure and financial services qualify him for the position.COMMITTEES OF THE BOARD OF DIRECTORSBoard of Directorsthe followingthree standing committees: (1) Audit Committee, and (2) Governance, Compensation and Nominating Committee ("GCN"), and (3) Pricing Committee. The Board has adopted a written charter for each of these committees,the Audit and GCN Committees, copies of which can be found inare located on the Governance page of the Investor Relations section of our website at www.aemetis.com. The Board of Directors has determined that all members of boththese two committees of the Board are independent under the applicable rules and regulations of NASDAQ and the SEC, as currently in effect.charttable details the current membership of each committee: of Director

CommitteeAuditNominatingPricing

CommitteeM = MemberC = Chair

The Audit Committee (i) oversees our accounting, financial reporting and audit processes; (ii) appoints, determines the compensation of, and oversees the independent auditors; (iii) pre-approvespreapproves audit and non-audit services provided by the independent auditors; (iv) reviews the results and scope of audit and other services provided by the independent auditors; (v) reviews the accounting principles and practices and procedures used in preparing our financial statements; (vi) reviews our internal controls; and (vii) oversees, considersreviews and approves related party transactions.

The Audit Committee works closely with management and our independent auditors. The Audit Committee also meets with our independent auditors without members of management present on a quarterly basis following completion of our auditors’ quarterly reviews and annual audit and prior to our earnings announcements to review the results of their work. The Audit Committee also meets with our independent auditors to approve the annual scope and fees for the audit services to be performed.

Francis P. Barton, Timothy Simon and Naomi L. Boness, and Timothy A. Simon served as members of the Audit Committee in 2022,2023, with Mr. Barton serving as Chair. Each of the Audit Committee members is an independent director within the meaning set forth in the rules of the SEC and NASDAQ, as currently in effect. Our Board has determined that all current Audit Committee members meet the heightened independence criteria of Rule 10A-3 of the Securities Exchange Act applicable to Audit Committee members. In addition, the Board of Directors has determined that Mr. Barton is an “audit committee financial expert” as defined by SEC and NASDAQ rules, as currently in effect.

A copy of the Audit Committee’s written charter is available in the Investor Relations section of our website at www.aemetis.com. The Audit Committee held five (5)four meetings during the fiscal year 2022. Mr. Barton and Mr. Simon2023. All Committee members attended all of the meetings of the Audit Committee during fiscal year 2022, and Ms. Boness attended four (4) of the meetings during the fiscal year 2022.meetings.

The following is the report of the Audit Committee of the Board of Directors.

Notwithstanding anything to the contrary set forth in any of the Company’sCompany’s previous or future filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate filings made by the Company, including this Proxy Statement, in whole or in part, the following Audit Committee Report shall not be deemed to be “soliciting material”“soliciting material” or to be incorporated by reference into any prior or future filings made by the Company.

The Audit Committee has reviewed and discussed with management the Company’s audited financial statements for the fiscal year ended December 31, 2022.2023. In addition, the Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1, AU Section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T. The Audit Committee also has received the written disclosures and the letter as required by the Public Company Accounting Oversight Board Rule 3526 “Communications with Audit Committees Concerning Independence” and the Audit Committee has discussed with the independent auditors the independence of that firm.

Based on the Audit Committee’s review of the matters noted above and its discussions with the Company’s independent auditors and management, the Audit Committee recommended to the Board of Directors that the financial statements be included in the Company’s 20222023 Annual Report.

| |

|

Respectfully submitted by:

Francis P. Barton (Chair)

Naomi L. Boness

Timothy A. Simon

Governance, Compensation and Nominating Committee

The Governance, Compensation and Nominating Committee (i) annually evaluates and reports to the Board on the performance and effectiveness of the Board and management to assist themthe Board in serving the interest of the Company’s shareholders; (ii) identifies, interviews, recruits, and recommends candidates for the Board; (iii) reviews the qualification, capability, independence, diversity, and other relevant factors in connection with candidates recommended or nominated to the Board or its committees, (iv) reviews and approves corporate goals and objectives relevant to the chief executive officer’s compensation, evaluates the chief executive officer’s performance relative to goals and objectives, and sets the chief executive officer’s compensation annually; (v) evaluates and approves the chief executive officer’s recommendation with respect to the compensation of the other executive officers, including all other Named Executive Officers; (vi) develops and recommends governance principles applicable to the Company; and (vii) oversees the evaluation of the Board and management from a corporate governance perspective. The Governance, Compensation and Nominating Committee has authority to delegate these functions to a subcommittee of its members, but no delegation of authority was made in 2022.2023.

Francis P. Barton, Lydia I. Beebe, and John R. Block served as members of the Governance, Compensation and Nominating Committee in 2022,2023, with Ms. Beebe serving as Chair. Each member of the Governance, Compensation and Nominating Committee is an independent director within the meaning set forth in the rules of the SEC and NASDAQ, as currently in effect, including after giving consideration to the factors specified in the NASDAQ listing rules for compensation committee independence. The GCN Committee held six meetings during fiscal year 2023, and all Committee members attended all meetings.

The Governance, Compensation and Nominating Committee considers properly submitted stockholder recommendations for candidates for membership on the Board as described below under “Identification and Evaluation of Nominees for Directors.“Director Qualifications.” In evaluating such recommendations, the Governance, Compensation and Nominating Committee seeks to achieve a balance of knowledge, experience and capability on the Board and to address the membership criteria set forth under “Director Qualifications” below. Any stockholder recommendations proposed for consideration by the Governance, Compensation and Nominating Committee should include the candidate’s name and qualifications for membership on the Board and should be addressed to the attention of our Corporate Secretary, — Re: Stockholder Director Recommendation, at 20400 Stevens Creek Blvd., Suite 700, Cupertino, CA 95014.

Pricing Committee |

The Board has provided a specific delegation to the Pricing Committee to manage certain aspects of our ongoing At-the-Market ("ATM") sales of Company common stock, including determining the prices and quantities of stock to be sold through the ATM.

Director Qualifications

In planning for succession, the Governance, Compensation and Nominating Committee considers the overall mix of skills and experience of the Board and the types of skills and experience desirable for future Board members, in light of the Company’s business and long-term strategy. The Governance, Compensation and NominatingGCN Committee uses a variety of criteria to evaluate the qualifications and skills necessary for members of our Board, including relevant experience, capability, availability to serve, diversity, independence and other factors. Experiences, qualifications, skills and attributes prioritized by the committee include, but are not limited to:

- | leadership experience, including public company |

- | having broad experience at the policy-making level in business, government, education, technology or public |

- | having the highest professional and personal ethics and |

- | commitment to enhancing stockholder |

- | financial expertise, including |

All members of the Board are expected to have sufficient time to carry out his or hertheir duties, and to provide insight and practical wisdom based on his or hertheir past experience. A director’s service on other boards of public companies should be limited to a number that permit him or her,allows them, given individual circumstances, to perform thetheir director duties responsibly. Each director must represent the interests of Aemetis stockholders.

Identification and Evaluation of Nominees for Directors

The Governance, Compensation and Nominating Committee utilizesuses a variety of methods for identifying and evaluating nominees for director.directors. The Governance, Compensation and NominatingGCN Committee regularly assesses the appropriate size of the Board and whether any vacancies on the Board are expected due to retirement or otherwise. In the event that vacancies are anticipated or otherwise arise, the Governance, Compensation and NominatingGCN Committee considers various potential candidates for director. Candidates may come to the attention of the Governance, Compensation and NominatingGCN Committee through current members of the Board, professional search firms, stockholders, or other persons. These candidates are evaluated at regular or special meetings of the Governance, Compensation and NominatingGCN Committee, and may be considered at any point during the year. The Governance, Compensation and NominatingGCN Committee considers properly submitted stockholder recommendations for candidates for the Board. In evaluating such recommendations, the Governance, Compensation and NominatingGCN Committee uses the qualifications standards discussed above and seeks to achieve a balance of knowledge, experience, and capability on the Board.

A copy of the Committee’s written charter is available on the Governance page of the Investor Relations section of our website at www.aemetis.com. In fiscal year 2022, the Governance, Compensation and Nominating Committee held five (5) meetings. Mr. Barton and Ms. Beebe attended all of the meetings of the Governance, Compensation and Nominating Committee during fiscal year 2022; Mr. Block attended four (4) meetings during fiscal year 2022.

Code of Business Conduct and Ethics

The Board of Directors has adopted a Code of Business Conduct and Ethics whichthat applies to our directors and all of our employees, including our Chief Executive Officer, Chief Financial Officer, and any other principal financial officer, Controller and any other principal accounting officer and any other personpersons performing similar functions. The Code of Business Conduct and Ethics is posted on the Governance page of the Investor Relations section of our website at www.aemetis.com. The Code of Business Conduct and Ethics addresses, among other things, honesty and ethical conduct, conflicts of interest, compliance with laws, regulations and policies, including disclosure requirements under the federal securities laws, confidentiality, trading on inside information, and reporting of violations of the code. Aemetis will disclose any amendment to the Code of Business Conduct and Ethics or waiver of a provision of the Code of Business Conduct and Ethics that applies to the Company’s directors, Chief Executive Officer, Chief Financial Officer and any other principal financial officer, controller and any other principal accounting officer, and any other person performing similar functions and that relates to certain elements of the Code of Business Conduct and Ethics, including the name of the director or officer to whom the waiver was granted, on the Investor Relations section of our website at www.aemetis.com.granted. No waivers were granted during 2022.2023.

Insider Trading Policy |

As part of our commitment to high standards of ethical business conduct and compliance with applicable laws, rules and regulations, the Company has adopted an Insider Trading Policy and related procedures governing transactions in our securities by directors, officers, and employees that we believe are reasonably designed to promote compliance with insider trading laws, rules and regulations, and listing standards applicable to us. The Insider Trading Policy prohibits the unauthorized disclosure of any nonpublic information acquired in the workplace and the misuse of material nonpublic information in securities trading.

Anti-Hedging Policy

Our Insider Trading Policy also prohibits employees, officers and directors from engaging in hedging transactions relating to our stock. Additionally, their immediate families, members of their households and any person who receives material nonpublic information of the Company from such persons are similarly prohibited from engaging in such hedging transactions.

Compensation Committee Interlocks and Insider Participation

During fiscal year 2022,2023, no member of the Governance, Compensation and Nominating Committee was an officer or employee of the Company or had any relationship requiring disclosure under “Certain Relationships and Related Party Transaction” below. In addition, no member of the Governance, Compensation and NominatingGCN Committee or executive officer of the Company served as a member of the board of directors or compensation committee of any entity that has an executive officer serving as a member of our Board or Governance, Compensation and NominatingGCN Committee.

Relationship of Compensation Practices to Risk Management

The Company has reviewed and considered all of its compensation plans and practices and does not believe that its compensation policies and practices create risks that are reasonably likely to have a material adverse effect on the Company.

Legal Proceedings

None.

Annual Meeting Attendance

Communications with the Board of Directors

Although we do not have a formal policy regarding communications with the Board, stockholders may communicate with the Board by submitting an email to investors@aemetis.com or by writing to us at Aemetis, Inc., Attention: Investor Relations, 20400 Stevens Creek Blvd., Suite 700, Cupertino, CA 95014. Stockholders who would like their submission directed to a member of the Board may so specify. The Corporate Secretary or Assistant Secretary will review all communications. All appropriate business-related communications as reasonably determined by the Corporate Secretary or Assistant Secretary will be forwarded to the Board or, if applicable, to the individual director.

DIRECTOR DIVERSITY MATRIXDirector Diversity Matrix

In identifying and evaluating candidates for the Board, the Nominating and Corporate GovernanceGCN Committee considers the diversity of the Board, including diversity of skills, experiences and backgrounds.

The Board Diversity Matrix below presentsshows the Board’s diversity statistics as of the date of this Proxy Statement in the format prescribed by the Nasdaq rules.Statement:

Total Number of Directors | 6 | ||||

Part I: Gender Identity | Female | Male | Non-Binary | Did Not Disclose Gender | |

Directors | 2 | 4 | 0 | 0 | |

Part II: Demographic Background | |||||

African American or Black | 1 | ||||

White | 2 | 3 | |||

Did Not Disclose Demographic Background | |||||

Directors with Disabilities: 1 | |||||

Directors who are Military Veterans: 2 | |||||

Gender Identity | ||||||||||||||||||||

Female | Male | NonBinary | Undisclosed | Total | ||||||||||||||||

Total Directors | 2 | 4 | - | - | 6 | |||||||||||||||

Demographic: | ||||||||||||||||||||

African American | - | 1 | - | - | 1 | |||||||||||||||

White | 2 | 3 | - | - | 5 | |||||||||||||||

Undisclosed | - | - | - | - | - | |||||||||||||||

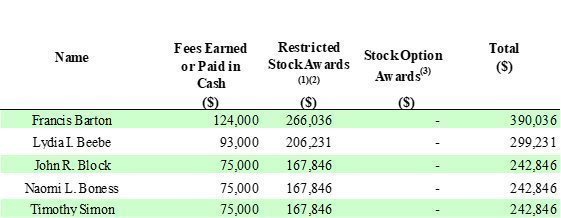

DIRECTOR COMPENSATIONDirector 2023 Compensation

The following table provides information regarding allshows compensation awarded to, earned by or paidawarded to each person who served as a non-employee directorDirectors of the Company for 2022.during 2023. Other than as set forth in the table and described more fully below, the Company did not pay any fees, holdaward any equity or non-equity awards, or pay any other compensation, to its non-employee directors. All compensationCompensation paid to Eric A. McAfee, Chair of the Board and Chief Executive Officer, and employee director, is set forth in the tables summarizing executive officer compensation below.later in this document.

Name | Fees Earned ($) | Stock Awards (Shares) | Stock Awards ($) | Total ($) | ||||||||||||

Francis P. Barton | $ | 124,000 | 17,070 | $ | 64,013 | $ | 188,013 | |||||||||

Lydia I. Beebe | $ | 93,000 | 13,570 | $ | 50,888 | $ | 143,888 | |||||||||

John R. Block | $ | 75,000 | 11,070 | $ | 41,513 | $ | 116,513 | |||||||||

Naomi L. Boness | $ | 75,000 | 11,070 | $ | 41,513 | $ | 116,513 | |||||||||

Timothy A. Simon | $ | 75,000 | 11,070 | $ | 41,513 | $ | 116,513 | |||||||||

(1) "Stock Awards" listed above are in the form of Restricted Stock Awards (RSAs) with immediate vesting under the Aemetis, Inc. Amended and Restated 2019 Stock Plan.

|

|

|

|

|

|

InSince 2007, the Board adoptedhas applied a director compensation policy pursuant tounder which each non-employee director is paid an annual cash retainer of $75,000. In January 2021, the Governance, Compensation and Nominating Committee set the payment of meeting attendance fees at $4,000 and determined to make annual stock grants in lieu of cash.

In addition, each non-employee director is initially granted an option exercisable for 10,000 shares of the Company’s common stock, which vests quarterly over two years subject to continuing service to the Company. In January 2022 and August 2022, each non-employee director was granted 10,371 and 5,000 restricted stock awards, respectively. Ms. Beebe was granted 12,871 and 6,000 restricted stock awards in the same periods respectively to recognize her services as chair of the Governance, Compensation and Nominating Committee. Mr. Barton was granted 16,371 and 8,000 restricted stock awards in the same periods respectively to recognize his service as chair of the Audit Committee. In addition,we pay an annual cash retainer of $24,000 is paid to the Lead Independent Director, an annual retainer of $18,000 is paid to the chairmanChair of the Governance, Compensation and Nominating Committee, and an annual cash retainer of $25,000 is paid to the chairmanChair of the Audit Committee. In January 2021, the Governance, Compensation and Nominating Committee set the payment for meeting attendance fees at $4,000 per year and determined to make this payment in stock grants in lieu of cash. Each non-employee director is initially, upon becoming a director, granted an option exercisable for 10,000 shares of the Company’s common stock that vests quarterly over two years subject to continuing service to the Company.

In addition, directors are typically granted additional equity awards each year in the discretion of the GCN Committee. In 2023, each non-employee director was granted 10,000 shares of stock as compensation and 1,070 shares in lieu of meeting fees, for a total of 11,070 shares. Ms. Beebe was granted an additional 2,500 additional shares as Chair of the GCN Committee and Mr. Barton was granted an additional 6,000 shares as Lead Independent Director and Chair of the Audit Committee.

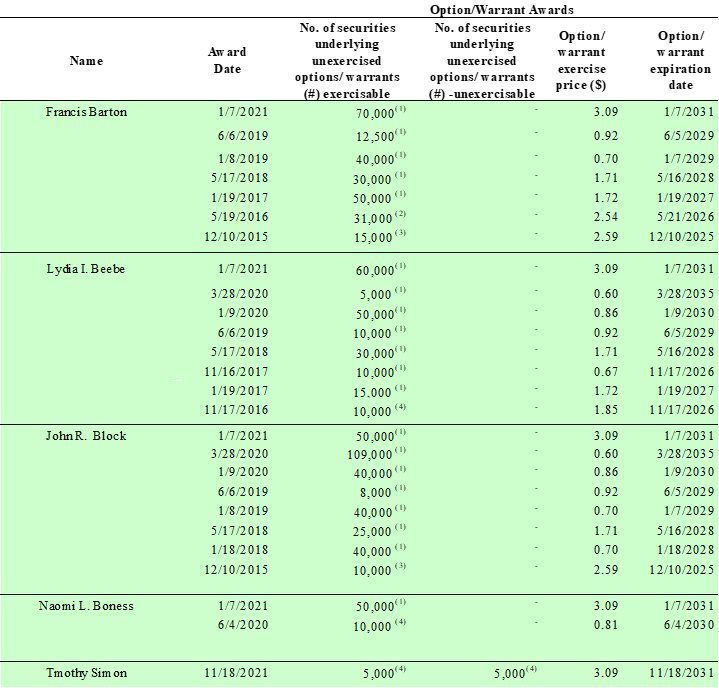

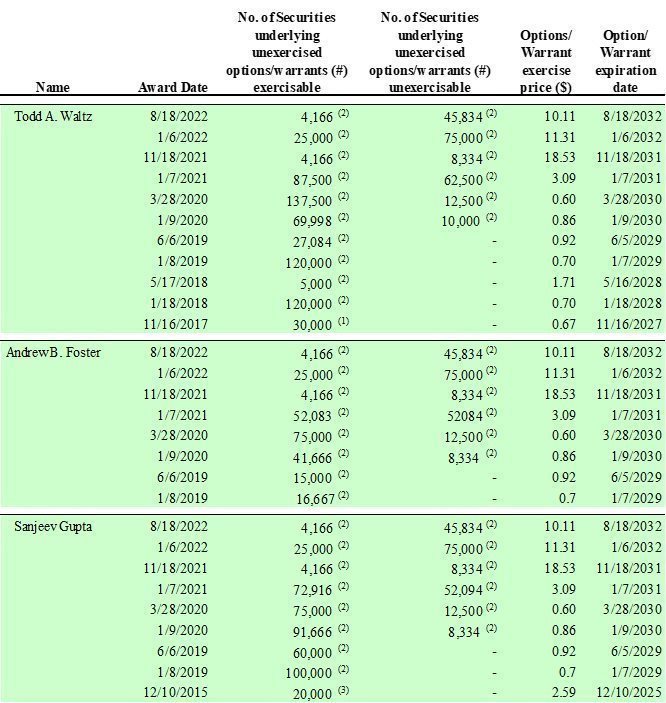

DIRECTORS’ OUTSTANDING EQUITY AWARDS AT FISCAL YEAR END (2022)Directors Outstanding Equity-Based Awards

The following table shows all outstanding equity awardsoptions and warrants held by each person serving as aindependent director of the Company at the endas of 2022.December 31, 2023:

Name | Award Date | Number of Shares (all exercisable) | Exercise price | Expiration Date | |||||||

Francis P. Barton | 12/10/2015 | 15,000 | $ | 2.59 | 12/10/2025 | ||||||

5/19/2016 | 31,000 | $ | 2.54 | 5/21/2026 | |||||||

1/19/2017 | 50,000 | $ | 1.72 | 1/19/2027 | |||||||

5/17/2018 | 30,000 | $ | 1.71 | 5/16/2028 | |||||||

1/8/2019 | 40,000 | $ | 0.70 | 1/7/2029 | |||||||

6/6/2019 | 12,500 | $ | 0.92 | 6/5/2029 | |||||||

1/7/2021 | 70,000 | $ | 3.09 | 1/7/2031 | |||||||

Lydia I. Beebe | 11/17/2016 | 10,000 | $ | 1.85 | 11/17/2026 | ||||||

1/19/2017 | 15,000 | $ | 1.72 | 1/19/2027 | |||||||

11/16/2017 | 10,000 | $ | 0.67 | 11/17/2026 | |||||||

5/17/2018 | 30,000 | $ | 1.71 | 5/16/2028 | |||||||

6/6/2019 | 10,000 | $ | 0.92 | 6/5/2029 | |||||||

1/9/2020 | 50,000 | $ | 0.86 | 1/9/2030 | |||||||

3/28/2020 | 5,000 | $ | 0.60 | 3/28/2035 | |||||||

1/7/2021 | 60,000 | $ | 3.09 | 1/7/2031 | |||||||

John R. Block | 1/18/2018 | 40,000 | $ | 0.70 | 1/18/2028 | ||||||

5/17/2018 | 25,000 | $ | 1.71 | 5/16/2028 | |||||||

1/8/2019 | 40,000 | $ | 0.70 | 1/7/2029 | |||||||

6/6/2019 | 8,000 | $ | 0.92 | 6/5/2029 | |||||||

1/9/2020 | 40,000 | $ | 0.86 | 1/9/2030 | |||||||

3/28/2020 | 109,000 | $ | 0.60 | 3/28/2035 | |||||||

Naomi L. Boness | 6/4/2020 | 10,000 | $ | 0.81 | 6/4/2030 | ||||||

1/7/2021 | 50,000 | $ | 3.09 | 1/7/2031 | |||||||

Timothy A. Simon | 11/18/2021 | 10,000 | $ | 18.53 | 11/18/2031 | ||||||

|

|

|

|

|

|

|

|

ELECTION OF DIRECTORS

The Board of Directors consists of six (6) directors classified into three separate classes, consisting of two (2) directors in each of Class I, Class II and Class III, with one class being elected each year to serve a staggered three-year term. Under the current Certificate of Incorporation and Bylaws of the Company, elections of one class of directors are held at each annual meeting of stockholders and until their respective successors are duly qualified and elected or such earlier date of resignation or removal.stockholders. Following the Annual Meeting, the terms of office of the Class I, Class II and Class III directors will expire in 2025, 20242026 and 2026,2027, respectively.

NOMINEESNominees

The Board of Directors approved Lydia I. BeebeNaomi L. Boness and John R. BlockTimothy A. Simon as nominees for election to the Board as Class III directors at the Annual Meeting. If elected, Lydia I. Beebe and John R. Blockthey will serve as Class III directors for a three-year term expiring in 2026.2027. The nominees are currently directors of the Company. Please see above for information concerningabout our incumbent directors’ standings for re-election.directors.

Unless otherwise instructed, the proxy holders will vote the proxies received by them FOR the nominees set forth above.nominees. If either nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for another nominee designated by the Board of Directors. We are not aware of any reason that the nominees would be unable or unwilling to serve as directors.

VOTE REQUIREDVote Required

If a quorum is present at the meeting, the two director nominees receiving the highest number of votes will be elected to the Board. Withheld, abstentions and broker non-votes will have no effect on the election of directors. Proxies may not be voted for a greater number of persons than the number of nominees named.

BOARD RECOMMENDATIONExcept for establishing a quorum, withheld, abstentions and broker non-votes will have no effect on the formal election of directors, provided that a Director who receives more "withheld" votes that "for" votes will be requested to comply with the Company's "plurality-plus" policy described in Section 3.A. of the Company's Corporate Governance Guidelines. This policy requires such director to submit their resignation to the Board and a formal Board determination of whether to accept the resignation based on the process described in the Guidelines.

Board Recommendation

THE BOARD RECOMMENDS A VOTE “FOR”“FOR” THE ELECTION OF EACH OF THE NOMINEES.

RATIFICATION OF AUDITORSAUDITOR

The Board has selected RSM US LLP as the Company’s independent auditor to audit the financial statements of the Company and its subsidiaries for the fiscal year ending December 31, 2022.2024. The Board recommends that stockholders vote for ratification of suchthis appointment. Although ratification by stockholders is neither required by law nor binding on the Board, the Board has determined that it is desirable to request ratification of this selection by the stockholders. Notwithstanding the selection, the Board, in its discretion, may direct the appointment of new independent auditors at any time during the year if the Board feels that such a change would be in the best interest of the Company and its stockholders. In the event of a negative vote on ratification, the Board will reconsider its selection. The aggregate fees billed for services rendered byA RSM US LLP during the years ended December 31, 2021 and 2022 are described below under the caption “Principal Accountant Fees and Services.” A representative of RSM US LLP is expected to be present atwill attend the Annual Meeting to answer appropriate questions and will have an opportunity to make a statement if he or she so desires and will be available to respond to appropriate questions.

Principal Accountant Fees and Services

Auditor Fee and Services in Fiscal Years 2021 and 2022

they desire. RSM US LLP was initially appointed as our registered independent public accountant on May 21, 2012. The following table lists the aggregate fees billed by RSM US LLP for services rendered during the audits of the Company’s 2021years ended December 31, 2022 and 2022 financial statements are as follows:2023:

|

| 2021 |

|

| 2022 |

| ||||||||||

Category | 2022 | 2023 | ||||||||||||||

Audit Fees |

| $ | 402,275 |

|

| $ | 428,150 |

| $ | 431,275 | $ | 753,750 | ||||

Audit-Related Fees |

|

| 96.075 |

|

|

| 38,125 |

| $ | 25,000 | $ | 40,750 | ||||

Tax Service Fees |

|

| - |

|

|

| 23,625 |

| ||||||||

Tax Fees | $ | 23,625 | $ | 36,750 | ||||||||||||

All Other Fees |

|

| - |

|

|

| 26,942 |

| $ | 26,942 | $ | 0 | ||||

Total Audit and Audit-Related Fees |

| $ | 501,350 |

|

| $ | 516,842 |

| ||||||||

Total | $ | 506,842 | $ | 831,250 | ||||||||||||

Audit Fees consist of fees billed for professional services rendered for the audit of the Company’s consolidated annual financial statements, and review of the interim consolidated financial statements included in quarterly reports, and services that normally provided by RSM US LLP in connection with statutory and regulatory filings or engagements.

Audit-Related Fees consist of assistanceservices provided with respectby RSM related to the Form S-8, Prospectus Supplement, and Comfort Letters. Tax Fees are for professional services rendered by RSM assisting with tax compliance, tax advice, and tax planning. All Other Fees are related to assessment of requirements for the Company Enterprise Resource SystemPlanning (ERP) by RSM’s ERP group.system.

Audit Committee’s Pre-ApprovalCommittee’s Preapproval Policies and Procedures

Consistent with policies of the SEC regarding auditor independence and the Audit Committee charter, the Audit Committee has the responsibility for appointing, setting compensation, and overseeing the work of the registered independent public accounting firm (the “Firm”). The Audit Committee’s policy is to pre-approvepreapprove all audit and permissible non-audit services provided by the Firm. Pre-approvalPreapproval is detailed as to the particular service toor category of services and is generally subject to a specific budget. The Audit Committee may also pre-approvepreapprove particular services on a case-by-case basis. In assessing a request for services by the Firm, the Audit Committee considers whether such services are consistent with the Firm’s independence, whether the Firm is likely to provide the most effective and efficient service based upon theirits familiarity with the Company, and whether the service could enhance the Company’s ability to manage or control risk or improve audit quality.

In fiscal years 20212022 and 2022,2023, all fees identified above under the captions “Audit Fees” and “Audit-Related Fees” that were billed by RSM US LLP were approved by the Audit Committee in accordance with the Audit Committee's procedures and SEC requirements.

VOTE REQUIREDVote Required

Approval of Proposal No. 2 requires the affirmative vote of a majority of the shares entitled to vote and present in person or represented by proxy at the Annual Meeting. Abstentions will be counted towards a quorum and have the same effect as votes “AGAINST” this proposal.an "against" vote.

BOARD RECOMMENDATIONBoard Recommendation

THE BOARD RECOMMENDS THAT YOU VOTE “FOR”“FOR” THE RATIFICATION OF RSM US LLP AS THE COMPANY’SCOMPANY’S INDEPENDENT AUDITORS.

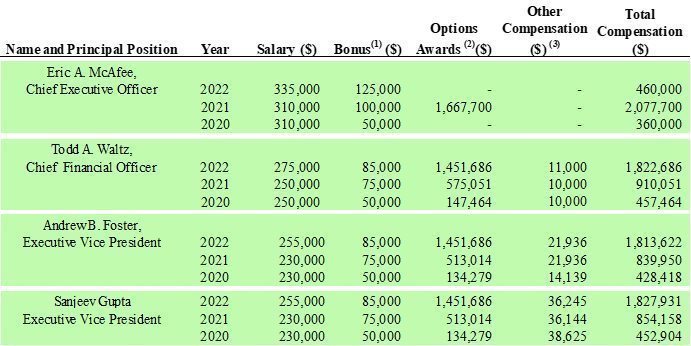

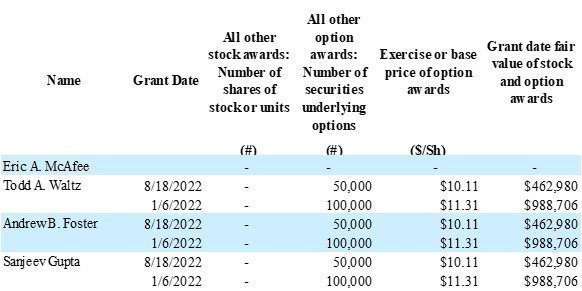

EXECUTIVE COMPENSATIONAUDITOR.

COMPENSATION DISCUSSION AND ANALYSIS

OverviewAMEND DELAWARE CERTIFICATE OF INCORPORATION

TO REDUCE AUTHORIZED PREFERRED SHARES

The Board of Directors is recommending an amendment to our Certificate of Incorporation filed with the State of Delaware to reduce the number of authorized preferred shares from 65,000,000 to 1,000,000.

Explanation

The Company's current Certificate of Incorporation authorizes the Company to issue up to 65 million shares of preferred stock and up to 80 million shares of Common Stock. The Company does not currently have any issued or outstanding shares of preferred stock.

The Board of Directors has approved an amendment to Article IV, Section 1, of our Certificate of Incorporation to reduce the number of authorized preferred shares from 65 million to one million. The Company recently converted all outstanding preferred shares into common stock to simplify our capital structure and provide clarity with respect to the rights of our common stockholders. The reduction in authorized shares will continue to support these purposes. In addition, reducing the number of authorized shares will reduce certain fees the Company pays that are based on the number of authorized shares, which is expected to reduce the Company's expenses by about $50 thousand to $100 thousand per year. The specific changes to the Certificate of Incorporation that would be authorized by this proposal are:

"Section 1. The total number of shares of all classes of capital stock that the Corporation shall have authority to issue is 145,000,00081,000,000 of which (i) 80,000,000 shares shall be a class designated as common stock, par value $0.001 per share (“Common Stock”), and (ii) 65,000,0001,000,000 shares shall be a class designated as preferred stock, par value $0.001 per share (“Preferred Stock”)."

The general description of the proposed amendment set forth herein is qualified in its entirety by reference to the proposed Amended and Restated Certificate of Incorporation, which is attached as Exhibit A to this proxy statement.

Vote Required

Approval of Proposal No. 3 requires the affirmative vote of a majority of the shares entitled to vote as of the record date. Abstentions and broker non-votes, if any, will have the same effect as an "against" vote. Brokers do not have authority to vote on Proposal 3 without instructions from the beneficial owner.

Board Recommendation

THE BOARD RECOMMENDS A VOTE “FOR” THE AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO REDUCE THE NUMBER OF AUTHORIZED PREFERRED SHARES.

AMEND DELAWARE CERTIFICATE OF INCORPORATION

TO ADD OFFICER EXCULPATION

The Board of Directors is recommending an amendment to our Certificate of Incorporation filed with the State of Delaware to adopt recent changes in Delaware law that allow for exculpation of officer liability in certain matters.

Explanation